Simplified Form 16 Issuance with Vyapar Samadhan

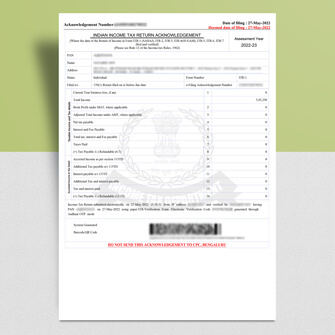

Form 16 holds paramount importance in the income tax return (ITR) filing process, particularly for salaried individuals. It serves as an official certificate for Tax Deducted at Source (TDS), offering a comprehensive overview of an employee's earnings, including salary, allowances, and additional benefits, for a specific financial year. Form 16 further provides a detailed breakdown of the tax deducted from the employee's income, covering salary and other perks received during that fiscal year.

At Vyapar Samadhan, we facilitate a hassle-free and compliant process for employers to generate and manage Form 16. Here's why Form 16 issuance with Vyapar Samadhan is streamlined and efficient:

What is Form 16?

Form 16, issued under Section 203 of the Income Tax Act, 1961, is a detailed certificate that outlines an employee's salary income and corresponding deductions made by the employer for tax purposes. It acts as tangible proof of Tax Deducted at Source (TDS) and is crucial when preparing and submitting income tax returns.

Key Components of Form 16:

- Part A - Personal Information:

- Detailed section containing personal information of both the employee and the employer.

- Comprehensive information about quarterly TDS deductions and deposits, including employer's PAN and TAN.

- Part B - Income Details:

- Provides a comprehensive breakdown of the employee's income from salary.

- Includes basic salary details, allowances, bonuses, perquisites, and a detailed breakdown of exemptions and deductions under Chapter VI-A.

Importance of Form 16:

- Streamlined ITR Filing: Simplifies the filing of Income Tax Returns (ITR) for employees.

- Independent ITR Preparation: Enables employees to independently prepare their ITR, reducing the need for financial advisors.

- Tax Deposit Verification: Aids in verifying the amount of Tax deposited by cross-referencing with Form 26AS.

- TDS Confirmation: Serves as proof of Tax Deducted at Source (TDS) and the income received.

- Income Documentation: Authenticates an individual's income, providing a credible record.

- Loan Verification: Essential for loan applications, enabling organizations to verify financial credibility.

- Onboarding Requirement: Often required during the onboarding process with new employers.

- Visa Application: Crucial checklist for visa applications, especially for foreign trips.

When will Form 16 be issued?

Form 16 is mandatory when Tax has been deducted from an employee's salary income. According to income tax regulations, employers must provide Form 16 to their employees by June 15th. This certificate pertains to the preceding financial year for which the salary has been disbursed. It comprehensively presents information regarding deducted Tax, received salary income, and exemptions and deductions availed by the employee throughout the financial year.

How to Get Form 16:

- Through Your Employer: Your employer is the primary source for obtaining Form 16 for the current financial year.

- After Leaving Your Job: Even if you've left your job during the financial year, you can still obtain Form 16 from your previous employer.

Effortless Form 16 Retrieval with Vyapar Samadhan:

Vyapar Samadhan simplifies the retrieval of Form 16 for employers, offering a user-friendly solution to generate and manage these critical documents. This streamlined process ensures compliance with tax regulations and provides several benefits for both employers and employees. Through Vyapar Samadhan, employers can efficiently and accurately provide their employees with Form 16 documents, contributing to a smooth income tax return filing process and enhancing financial transparency within the organization.