- Definition: A Section 8 Company is a non-profit aiming to promote charitable activities like education, sports, and more.

- Vyapar SamadhanAssistance: Vyapar Samadhanoffers end-to-end services for quick and hassle-free Section 8 company registration in India.

- Definition (Detailed): As per Companies Act 2013, Section 8 companies utilize profits for social causes and avoid distributing dividends.

- Overview: Registered for non-profit activities, a Section 8 Company promotes education, social welfare, and more under Companies Act 2013.

- Key Points:

- NGOs can register under Section 8 or Registrar of Societies.

- Profits must be used for charitable purposes; strict compliance required.

- Benefits:

- Tax exemption for 100% of profits used for charitable purposes.

- No minimum capital requirement offers flexibility.

- Separate legal entity status enhances credibility.

- Eligibility Criteria:

- Indian national or HUF can incorporate.

- At least one director required.

- Objectives related to social welfare must be primary.

- Legal Requirements:

- Minimum two directors for private, three for public.

- No minimum capital required.

- Objects must align with non-profit goals.

- Documents Required:

- AOA and MOA.

- Declaration by first director(s).

- Proof of office address.

- Consent of Nominee (INC-3).

- Incorporation Process:

- Obtain DSC and DIN.

- Reserve company name.

- File application for incorporation.

- Obtain license for Section 8 Company.

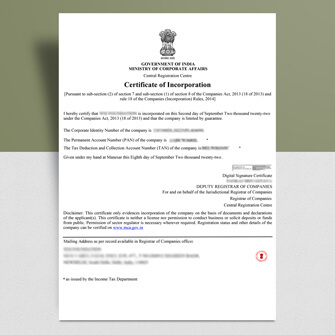

- Obtain Certificate of Incorporation.

- Donations/Funding:

- Cannot collect capital through deposits.

- Accepts donations, foreign and domestic.

- FCRA registration required for foreign contributions.

For professional assistance, connect with Vyapar Samadhanfor Section 8 Company Registration.