TDS Return Filing: Simplified Overview

What is TDS Return Filing?

TDS (Tax Deducted at Source) return filing is a quarterly statement submitted to the Income Tax Department by the deductor. It is crucial to file TDS returns on time. The process is entirely online, and details submitted reflect in Form 26AS. Key information includes PAN of the deductor and deductee, the amount of tax paid to the government, TDS challan details, and any other relevant information.

Understanding TDS:

TDS, or Tax Deducted at Source, is the tax collected by the Indian Government at the time of a transaction. It is deducted when money is credited to the payee's account or at the time of payment, whichever occurs earlier. Typically, TDS amounts to 10% of the transaction.

What is TAN?

TAN, or Tax Deduction and Collection Number, is a mandatory 10-digit alphanumeric code obtained by those responsible for deducting or collecting tax at source. Salaried individuals need not obtain TAN, but businesses and entities making specified payments, like salary or rent exceeding Rs. 2,40,000 per year, require TAN. Vyapar Samadhan can assist in TAN registration.

Eligibility and Due Dates:

TDS return filing is done by organizations or employers with a valid TAN. Individuals making specified payments mentioned in the Income Tax Act must deduct taxes at source. Due dates for TDS return filing vary by quarter.

- 1st Quarter (April to June): Deadline - 31st July

- 2nd Quarter (July to September): Deadline - 31st October

- 3rd Quarter (October to December): Deadline - 31st January

- 4th Quarter (January to March): Deadline - 31st May

TDS Return Filing Procedure:

Filing TDS returns online involves several steps:

- Fill Form 27A and verify it along with the E-TDS return.

- Correctly fill and tally the deducted tax and total amount paid.

- Mention the TAN of the organization on Form 27A.

- Provide accurate challan numbers, payment modes, and tax details.

- Use the basic Form for e-TDS filing, entering the 7-digit BSR for consistency.

- Submit physical TDS returns at TIN FC or online on the NSDL TIN website.

- Receive a token number or provisional receipt as proof of filing.

- In case of rejection, address the non-acceptance memo and refile returns.

TDS Return Forms:

Different TDS forms are used based on deductees and income types:

- Form 24Q: Quarterly statement for TDS from salaries.

- Form 26Q: Quarterly statement of TDS for payments other than salaries.

- Form 27Q: Quarterly statement of TDS from payments to non-residents.

- Form 27EQ: Quarterly statement of tax collected at source.

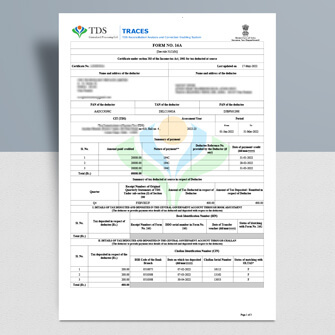

TDS Certificate and Penalties:

After deducting TDS, a valid TDS certificate is furnished to the deductee. Failure to file TDS returns on time incurs a penalty of Rs.200 per day (Section 234E). Non-filing or incorrect information may result in a penalty ranging from Rs.10,000 to Rs.1,00,000.

Revised TDS Returns and Claiming TDS Credit:

Revised TDS returns can be filed if errors are detected, ensuring proper reflection of credits. Deductors claim TDS credit by mentioning details in their income tax returns. Accurate TDS certificate numbers and details must be provided to avoid discrepancies.

Vyapar Samadhan' TDS experts can assist with TDS registrations, computations, filing, and compliance with TDS regulations.