Simple and Professional Guide to GSTR-9 Filing

Introduction to GSTR-9:

GSTR-9 is a crucial annual filing requirement for all taxpayers under the Goods and Services Tax (GST) system.

It consolidates comprehensive information on outward and inward supplies, covering transactions throughout the

financial year, including those regulated by CGST, SGST, and IGST.

Vyapar Samadhan: Your GSTR-9 Filing Partner:

At Vyapar Samadhan, we specialize in simplifying the GSTR-9 filing process. Recognizing the complexity of tax

matters, we streamline the procedure and guide you through each step. With our expertise and user-friendly

approach, you can confidently handle your GSTR-9 filings with accuracy.

Make Vyapar Samadhan your partner in GSTR-9 filings. Get started today and experience a stress-free way to

fulfill your tax responsibilities.

Understanding Form GSTR-9:

GSTR-9 is an annual report summarizing all business transactions, including purchases, sales, different taxes

(CGST, SGST, IGST), and audit details. It is a consolidation of monthly or quarterly returns submitted

throughout the fiscal year.

Applicability of GSTR-9:

Entities such as normal taxpayers, SEZ units, SEZ developers, and those transitioning from the composition

scheme are obligated to submit GSTR-9. However, certain categories like composition taxpayers, casual taxpayers,

non-resident taxpayers, and ISD/OIDAR service providers are exempt.

Types of GST Annual Returns:

- GSTR-9: Mandatory for entities with a turnover exceeding 2 crores, compiling comprehensive financial

information.

- GSTR-4: Specifically for registered taxpayers under the composition scheme, addressing their unique

requirements.

- GSTR-9C: A reconciliation statement between GSTR-9 and audited financial statements, applicable to taxpayers

with a turnover exceeding five crores requiring an annual audit.

Filing GSTR-9A for Composition Scheme Participants:

Applicable to GST-registered taxpayers operating under the composition scheme, GSTR-9A compiles information

submitted in their quarterly returns throughout the fiscal year. Exempt entities include Input Service

Distributors, non-resident taxable individuals, those under TDS or TCS, and casual taxable individuals.

Filing GSTR-9C: Reconciliation Statement:

GSTR-9C is filed by taxpayers subjected to an annual GST audit. It serves as a reconciliation between GSTR-9 and

audited financial statements, with preparation and certification handled by qualified Chartered or Cost

Accountants.

Due Date and Penalties:

The due date for GSTR-9 filing is 31st December of the subsequent financial year or as extended by the

Government. Late filing incurs penalties of Rs.50 per day for turnover up to 5 Crore, Rs. 100 per day for

turnover from 5 Crore to 20 Crore, and Rs. 200 per day for turnover above 20 Crore (50 % of penalty each for

CGST and SGST) up to the quarterly turnover amount.

Comprehensive Structure of GSTR-9:

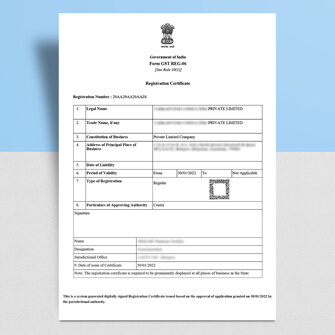

The format is divided into six parts, capturing details like basic registration information, outward supplies,

input tax credit, tax paid, transactions of the previous financial year, and miscellaneous details.

Prerequisite Actions for Annual Filing:

Before filing GSTR-9, ensure completion of other GST-related filings, including GSTR-1, GSTR-3B, or GSTR-

CMP-08. Address any outstanding dues to avoid hindrances.

How Vyapar Samadhan Can Assist:

Vyapar Samadhan provides expert guidance, data verification, timely reminders, and comprehensive services beyond

form-filling. With us, you can file GSTR-9 confidently, ensuring accuracy and compliance.

Ready to simplify your GSTR-9 filing? Let Vyapar Samadhan be your trusted partner in tax compliance. Get started

today and experience a stress-free way to fulfill your obligations. Contact us now!