Effortless ITR-2 Form Filing with Vyapar Samadhan

What is ITR 2?

ITR, or Income Tax Return, is a vital document where taxpayers declare their income and taxes. ITR-2 is designed for individuals and Hindu Undivided Families without income from professional or business activities.

Eligibility for ITR 2 Form

For individuals and HUFs with income from sources like Salary, Pension, House Property, Capital Gains, Other Sources, Agricultural income over Rs 5,000, Foreign Income, or Directorship in companies.

Who Shouldn't File ITR 2?

Not for those with income from business or professional activities. ITR-1 form is suitable for such cases.

Structure of ITR-2 Form

- Part A: General Information

- Personal details, PAN, Aadhar, contact info.

- Part B: Computation of Total Income

- Gross Total Income calculation.

- Deductions for tax savings.

- Part B-TI & B-TTI: Tax Liability Computation

- Tax liability calculation using Total Income.

Documents Needed for Filing ITR-2

- Form 16/16A: Salary and TDS details.

- Form 26AS: Tax credits, TDS details.

- Bank Statements: Income from interest, dividends.

- Capital Gains Details: If applicable.

- Foreign Assets and Income Documents: If applicable.

- Aadhaar, PAN, and Identification Docs.

Instructions for Completing ITR-2 Form

- Follow the sequence: Part A, schedules, Part B-TI, Part B-TTI, and verification.

- Strike out inapplicable schedules, mark 'NA.'

- Round off figures to the nearest rupee.

- Choose 'Government' if applicable.

- No use for double taxation relief claims under specific sections.

Modes of Submission for ITR-2

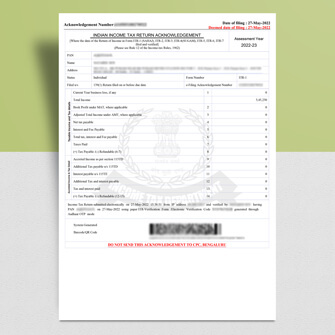

- Offline Filing:

- Physical paper return or bar-coded form.

- Acknowledgment received on submission.

- Online Filing:

- Electronic submission with or without a digital signature.

- Verification through Return Form ITR-V.

- Acknowledgment sent via email for digital signature submissions.

Why Choose Vyapar Samadhan for ITR-2?

- Expert Guidance: Seasoned professionals ensure accuracy and compliance.

- Convenience: Easy online platform for hassle-free filing.

- Accuracy: Thorough review minimizes future tax-related issues.

- Timely Filing: Prompt submissions to avoid penalties.

Contact Vyapar Samadhan today for a stress-free ITR-2 filing experience. Your taxes, handled with expertise and care.