Are you an exporter looking to simplify your business operations? The GST LUT Form is an essential

document that enables you to seamlessly conduct your export transactions without paying Integrated

Goods and Services Tax (IGST) at the time of supply. Vyapar Samadhan is here to assist you in

efficiently completing the GST LUT Form filing process, making your export journey smoother than

ever.

Understanding LUT in GST

LUT, an acronym for Letter of Undertaking holds significant relevance within the context of the Goods

and Services Tax (GST) framework. This document serves as a powerful tool for exporters, allowing

them to engage in the export of goods or services without the obligation of immediate tax payment.

GST LUT Form for Exporters

For all registered taxpayers engaged in the export of goods or services, it is mandatory to provide a

Letter of Undertaking (LUT) using the Form GST RFD-11 form on the GST portal. This obligation is

essential to facilitate exports without paying Integrated Goods and Services Tax (IGST).

Eligibility criteria

The Eligibility criteria for applying for a LUT include the following:

The Letter of Undertaking (LUT) is open for utilization by any registered taxpayer engaged in

exporting goods and services. However, individuals facing prosecution for tax evasion exceeding Rs.

250 lakh or more are ineligible to benefit from this option.

-

Intent to Supply:The applicant should intend to supply goods or services within

India, to foreign countries, or to Special Economic Zones (SEZs).

-

GST Registration:The entity seeking to avail the benefits of an LUT should

be registered under the GST framework.

-

Tax-Free Supply:The desire to supply goods without the imposition of

integrated tax is an essential requirement for LUT application.

Exploring the LUT Bond

LUTs hold a validity of one year, necessitating the submission of a fresh LUT for each subsequent

financial year. Should the terms outlined in the LUT fail to be met within the designated timeframe;

the privileges associated with it will be withdrawn, prompting the need for the exporter to provide

bonds.

For other assessments, bonds are required when conducting exports without Integrated Goods and

Services Tax (IGST) payment. LUTs and bonds are applicable in the following cases:

-

Zero-rated supply to SEZ:Exporting to Special Economic Zones (SEZs) without

IGST

payment.

-

Goods Export:

Exporting goods to a country beyond India without IGST payment.

-

Service Export:Providing services to clients in foreign countries without

IGST

payment.

Documents Required for LUT under GST

To apply for a Letter of Undertaking (LUT) under GST, you'll need the following documents:

-

KYC of Gaurantor:Self attested Copy of Aadhar Card and Pan Card of Two

guarantors.

-

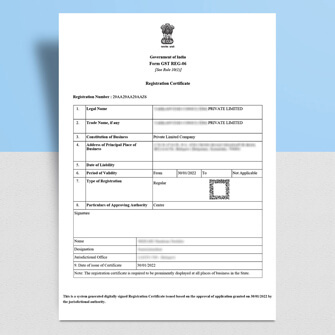

Copy of GST Registration:Proof of your GST registration.

-

PAN Card of Entity:Identification using PAN card

-

KYC of Authorized Person:ID and address proof of authorized person.

-

Authorized Letter:Granting power to the authorized signatory.

Advantages of Filing LUT for Exporters

Choosing to file a Letter of Undertaking (LUT) brings a host of benefits to exporters, streamlining

their export activities and optimizing their financial operations:

-

Tax-Free Export: Opting for the LUT enables exporters to carry out their

export transactions without the burden of immediate tax payment. This contrasts the

alternative, where taxes are paid and later claimed as refunds for zero-rated exports.

-

Simplified Process: By utilizing the LUT, exporters avoid the complexities

of claiming tax refunds or engaging in follow-ups with the tax authorities. This translates

to substantial time savings and operational ease.

-

Unblocked Working Capital: Funds that would have otherwise been locked as

tax payments remain accessible for exporters. This is especially vital for small and

medium-sized enterprises (SMEs) grappling with financing and working capital constraints.

-

Liberated Resources: Regular exporters find a consistent advantage with the

LUT. Once filed, the LUT remains valid for the entire financial year. This longevity

minimizes the need for repetitive filings, allowing exporters to focus on their core

activities

By leveraging the benefits of the LUT, exporters can navigate the realm of international trade with

greater efficiency and flexibility.

Key Reminders about LUT Bond in GST

Here are some crucial points to keep in mind regarding LUTs (Letter of Undertaking) in GST:

-

Validity Period :An LUT remains valid for a year, starting from the

submission date.

-

Conditional Acceptance:The acceptance of an LUT comes with specific terms.

Failing to meet these conditions might lead to privilege revocation. In such cases, an

entity may need to provide a bond.

-

Alternative Bonding:Entities ineligible for LUT can still furnish a bond.

This bond, usually on non-judicial stamp paper, requires a bank guarantee. The adhesive

should cover the anticipated tax liability based on exporter assessment.

-

Official Letterhead:LUT submissions must be on the registered entity's

letterhead. This letterhead is from the entity planning to supply goods/services without

integrated tax payment.

-

Prescribed Form:An LUT must be applied through the official GST RFD-11 form.

This form can be submitted by authorized personnel like the MD, company secretary, or

partners in a firm.

-

Flexible Filing:In the case of a company, the form can be submitted by a

partner in a partnership firm or the proprietor.

-

Bank Guarantee Limit:The accompanying bank guarantee should be at most 15%

of the bond amount. The jurisdictional GST Commissioner might waive this requirement.

Staying mindful of these details helps ensure a smooth process while dealing with LUT bonds under GST

regulations.

Simplify LUT Form Filing with Vyapar Samadhan

Navigating the complexities of LUT (Letter of Undertaking) filing for exporters has always been

challenging. At Vyapar Samadhan, we specialize in streamlining the process, allowing you to focus on

expanding your export operations. Our experienced professionals understand the nuances of GST

regulations and are well-equipped to guide you through the seamless submission of the GST RFD-11

form. We offer end-to-end support, from document preparation to online submission, ensuring accuracy

and compliance at every step. With Vyapar Samadhan by your side, you can unlock the benefits of

tax-free exports without the hassle of navigating complex procedures. Simplify your LUT filing today

and begin a smoother export journey with us.

Contact us to experience a hassle-free GST LUT filing process that empowers your export ventures like

never before.

RELATED GUIDES

GST LUT Form FAQ's

Is it mandatory to record them manually approved LUT in online records? It is

not mandatory, but if the Taxpayer wants to record the manually approved LUT to be available in

online records, he can furnish it with the online application.

Who has to sign the LUT application?

Primary authorized signatory/Any other Authorized Signatory needs to sign and file

the verification with DSC/EVC. The authorized signatory can be the working partner, the managing

director, or the proprietor or by a person duly authorized by such operating partner or Board of

Directors of such company or proprietor to execute the form.

How would I know that the process of furnishing the LUT has been completed?

After successful filing, the system will generate ARN and acknowledgment. You will

be informed about successful filing via SMS and Email, and you can also download the acknowledgment

as a PDF.

Is it possible to view the LUT application after filing?

Yes, the Taxpayer will be able to see his LUT after filing.

Is it mandatory to file GST LUT?

It is mandatory to furnish the Letter of undertaking (LUT) to export the goods,

services, or both without paying the IGST.

What happens when the exporter fails to furnish the LUT?

In case if the exporter fails to provide the LUT then he has to pay the IGST or

furnish an export bond.

Who is eligible to furnish LUT under GST?

Any person who is exporting goods or services can furnish the LUT.

Who is not eligible to furnish under GST?

A person who has been prosecuted for evading tax of Rs. 2.5 crore or above under

the act cannot furnish the LUT.

What documents are required for GST LUT filing?

LUT cover letter- duly signed by an authorized person Copy of the GST registration

PAN of the entity.