Ensuring Partnership Compliance with Ease

Running a Partnership Firm in India involves significant financial and legal obligations. Meeting tax and regulatory requirements is crucial for the business's seamless operation and growth. At Vyapar Samadhan, we recognize these responsibilities and offer comprehensive services to simplify compliance for business owners.

Key Aspects of Partnership Compliance:

- Tax Returns: Every Partnership Firm must file Income Tax Returns, TDS Returns, GST Returns, EPF Returns, and undergo Tax Audit when necessary.

- Vyapar Samadhan Assistance: Partnering with Vyapar Samadhan provides expert guidance, streamlining compliance processes for business owners. We help fulfill tax obligations and optimize tax benefits.

Understanding Partnership Firms:

- Registered vs. Unregistered: A partnership firm can be registered or unregistered, with the former having a formal registration with the RoC.

- Partnership Agreement: Partnership is an agreement where individuals share profits or losses from a jointly conducted business.

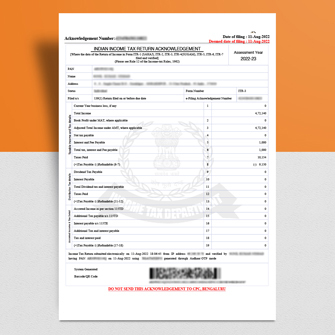

Income Tax Filing for Partnership:

- Annual Filing: All Partnership Firms must file income tax returns annually, even if there are no profits.

- Tax Slabs: Partnership firms are subject to a 30% income tax rate, with a 12% surcharge if income exceeds one crore rupees.

- Minimum Alternate Tax: Similar to companies, partnership firms are subject to a minimum alternate tax of 18.5%.

- Deductions Allowed: Deductions are permitted for specific partner-related payments and interest on capital.

ITR Forms for Partnership Firms:

Partnership firms can use either Form ITR-4 or ITR-5 for income tax return filing, depending on turnover and audit requirements.

Compliance Deadlines:

Filing deadlines vary based on audit requirements: July 31st for non-audit cases and October 31st if an audit is required.

GST Returns, TDS, EPF, and More:

- GST Returns: GST-registered firms must file GSTR-1, GSTR-3B, and GSTR-9 returns.

- TDS Returns: Filing TDS returns is mandatory for firms with a valid TAN, with various forms for different deductions.

- EPF Returns: EPF registration and return filing are required for firms employing more than ten persons.

Accounting and Bookkeeping:

Maintaining proper books of accounts is essential if the firm's turnover exceeds Rs. 25,00,000 or income exceeds Rs. 2,50,000 in the preceding three years.

Tax Audit:

A tax audit is mandatory for firms with sales, turnover, or gross receipts exceeding Rs. 1 crore in the financial year.

Simplify Compliance with Vyapar Samadhan:

Vyapar Samadhan is your trusted partner for streamlining partnership firm compliance. From income tax to GST and beyond, our comprehensive services ensure accuracy and timeliness, allowing you to focus on business growth.

Ready to experience seamless partnership compliance? Get started with Vyapar Samadhan for expert assistance and peace of mind.