Simplified ITR-4 (Sugam) Return Filing with Vyapar Samadhan

Navigating the complexities of income tax returns becomes effortless with Vyapar Samadhan. Our expert assistance ensures a smooth and accurate filing process for the ITR-4 Form, commonly known as the Sugam form. This form is specifically tailored for taxpayers who opt for the presumptive income scheme under Sections 44AD, 44ADA, and 44AE of the Income Tax Act.

Eligibility for Form ITR-4

ITR-4 is designed for individuals, Hindu Undivided Families (HUFs), and firms (excluding LLPs) utilizing the presumptive income scheme as per Sections 44AD, 44ADA, and 44AE. However, businesses with an annual turnover exceeding Rs. 2 Crores should use ITR-3, and ITR-5 may be necessary based on individual circumstances.

Presumptive Taxation Scheme Explained

This scheme simplifies tax compliance for certain individuals and businesses. Sections 44AD, 44ADA, and 44AE relieve small taxpayers from detailed accounting by allowing them to estimate income at prescribed rates.

- Section 44AD: For businesses in specific sectors, residents can calculate income on an estimated basis under certain conditions.

- Section 44ADA: Resident individuals in specified professions can estimate professional income under certain conditions.

- Section 44AE: Applicable to those engaged in the business of plying, leasing, or hiring goods carriages, with income estimation based on certain conditions.

Eligibility Criteria for ITR-4 (Sugam) Form

To use ITR-4, taxpayers must meet specific criteria:

- Total Income: Should not exceed Rs. 50 lakh.

- Income Sources: Includes salary, one house property, interest income, business income (presumptive basis), income from goods carriage business (presumptive basis), and professional income (presumptive basis under Section 44ADA).

Non-Applicability of ITR-4 Form

ITR-4 is not suitable for individuals:

- With Incomes From:

- Profits and gains not computed under Sections 44AD, 44ADA, or 44AE.

- More than one house property.

- Capital gains, lottery winnings, racehorse-related income, and specified taxed income.

- Business losses as per Section 44AE.

- Certain special rate-taxed income under Section 115BBDA or 115BBE.

- Income needing apportionment under Section 5A.

- Agricultural income exceeding Rs. 5,000.

- Having Claims For:

- Losses carried forward.

- Relief claims under Section 9A, 90, or 91.

- Loss from other sources.

- Deductions under Section 57 (except for family pension).

- Tax credit claims for tax deducted at source in someone else's hands.

Structure of the ITR-4 Form

The ITR-4 form comprises four parts:

-

Part A: General Information

- Personal details, PAN, assessment year, and contact information.

-

Part B: Gross Total Income

- Income details from various sources, calculating gross total income.

-

Part C: Deductions and Total Taxable Income

- Listing deductions under various sections, arriving at total taxable income.

-

Part D: Tax Computation and Tax Status

- Detailed tax liability calculations, considering surcharge, relief, interest, advance tax, TCS, refund, and cess.

For businesses opting for the presumptive income scheme, additional schedules (IT, TCS, TDS1, TDS2) may be required.

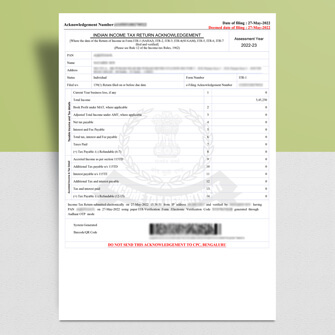

Annexure-less Return Form

Using the Sugam form, no additional documents need to be uploaded, making the filing process simpler.

Why Choose Vyapar Samadhan for ITR-4 Filing?

- Expert Guidance: Our professionals ensure accurate compliance with tax regulations.

- Convenience: File ITR-4 online from the comfort of your home or office, eliminating queues and paperwork.

- Accuracy: Rigorous reviews reduce the risk of future tax-related issues.

- Timely Filing: Prompt submissions help you avoid penalties and meet tax deadlines.

Contact Vyapar Samadhan today, and our dedicated team will assist you at every stage of the process. Simplify your ITR-4 filing experience with us!