Simple and Professional Guide to GST Return Filing

Understanding GST Return Filing:

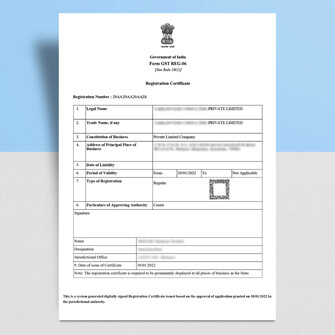

GST return filing is a crucial aspect for businesses registered under GST, requiring them to file

returns monthly, quarterly, or annually based on their business type. This involves detailing

sales or purchases, along with the taxes collected and paid. A comprehensive tax system like GST

in India ensures aligned taxpayer services, covering registration, returns, and compliance.

Forms for GST Return Filing:

Individuals filing GST returns need to submit four forms – returns for supplies, purchases,

monthly returns, and annual returns. These forms provide a comprehensive overview of a

taxpayer's financial activities.

Eligibility Criteria:

-

Anyone with a valid GSTIN must file GST returns.

-

Those with an annual turnover exceeding Rs. 20 lakhs are required to obtain GST

registration and file returns mandatorily.

-

Special states have a turnover limit of Rs. 10 lakhs.

Types of GST Registration:

Various forms cater to different business activities, such as GSTR 1 for outward supplies, GSTR

3B for summary returns, CMP 08 for composition scheme taxpayers, and GSTR 9 for annual returns.

GST Return Filing Due Dates:

Due dates vary for each return, such as the 11th for GSTR 1, 20th for GSTR 3B, and 31st December

for GSTR 9 (annual return). It's essential to adhere to these deadlines to avoid penalties and

maintain compliance.

GST Return Filing Process:

Vyapar Samadhan offers a streamlined GST return filing process, ensuring timely and accurate

submissions. With a dedicated GST advisor, the process becomes hassle-free:

-

Advisor Interaction:A dedicated GST advisor collects necessary

information, prepares the returns, and assists in the filing process.

-

Easy and Quick Filing: : With a turnaround time of 1 to 2 working days,

Vyapar Samadhan simplifies the filing process, ensuring prompt submissions.

Benefits of Choosing Vyapar Samadhan for GST Returns:

-

Dedicated GST Advisor:An experienced relationship manager guides

businesses through the registration and filing process, ensuring accuracy.

-

Timely Reminders: Vyapar Samadhan provides timely reminders, preventing

any missed deadlines and associated penalties.

-

Monthly GST Status Reports: Clients receive monthly reports on GST

return status, ensuring transparency.

Outsource GST Compliance to Vyapar Samadhan:

Outsourcing GST compliance to Vyapar Samadhan eases the burden on businesses, allowing them to

focus on growth. The dedicated GST Accountant ensures timely compliance of return filling with

accuracy and provide data related to GST returns.

Why Choose Vyapar Samadhan?

-

Dedicated GST Accountant: Each business gets a dedicated GST accountant

for personalized support.

-

Monthly Reports: Regular monthly reports detailing GST return status and

future actions are provided.

-

Compliances with accuracy: We ensures timely compliances of GST return

filling with accuracy.

In summary, GST return filing is a crucial aspect of GST compliance, and Vyapar Samadhan provides

businesses with a simplified, efficient, and compliant approach to this process.