Understanding and Responding to Income Tax Notices

The Income Tax Department issues notices for various reasons, such as non-filing of income tax returns, errors in filing returns, or requests for additional documents or information.

Receiving a notice is not a cause for alarm, but it's crucial for the taxpayer to comprehend the notice's nature, the requester's order, and take necessary steps for compliance.

Vyapar Samadhan provides a comprehensive range of services for families and businesses to assist in maintaining compliance. If you receive an income tax notice, reach out to our Tax Experts for guidance on understanding the notice and determining the appropriate course of action.

Types of Income Tax Notices -

- Notice u/s 143(1) - Intimation:

- Commonly received for errors, incorrect claims, or inconsistencies in filed returns.

- Response or revision within 15 days is essential.

- Notice u/s 142(1) - Inquiry:

- Issued when further details and documents are required from the assessee.

- Additional documents may be requested.

- Notice u/s 143(2) - Scrutiny:

- Issued when the tax officer is dissatisfied with submitted documents.

- Selected for detailed scrutiny, requiring additional information.

- Notice u/s 156 - Demand Notice:

- Issued when any tax, interest, fine, or sum is owed by the taxpayer.

- Specifies the outstanding amount due.

- Notice Under Section 245:

- Allows the setoff of the current year's refund against past tax demands.

- Response within 30 days is crucial to avoid default consent.

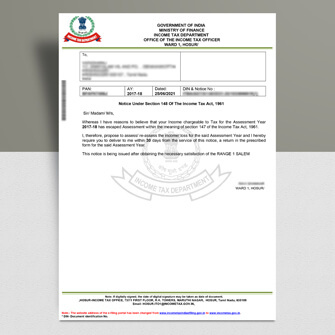

- Notice Under Section 148:

- Issued when the officer believes income disclosure or filing is incorrect.

- Requires the assessee to furnish their return of income.

Service of Income Tax Notice

The Income Tax Act, 1961, defines how notices are served:

- Directly addressed to the individual or guardian if meant for a minor.

- Service by post through registered mail.

- Service by affixture on the residence's noticeable part if acknowledgment is refused.

- Notice served to HUFs, partnership firms, or closed businesses based on specific conditions.

The required documents vary by notice type, but basic documents include:

Documents Required to Reply to an Income Tax Notice

- Copy of the Income Tax Notice.

- Proof of income sources (Form 16, salary receipts, etc.).

- TDS certificates (Form 16 Part A).

- Investment proofs, if applicable.

It is advisable to review the notice with tax experts for the best possible solution.

Checklist for Income Tax Notice

- Respond within 30 days of receiving the Section 143(1) notice.

- Cross-check name, address, PAN, and assessment year details.

- File revised returns within 15 days if needed.

- Verify e-filing acknowledgment number.

- Review reasons stated in the notice.

- File rectification returns if errors are found.

- Address demand notices promptly to avoid interest and penalties.

Vyapar Samadhan' Tax Experts can guide you through the process and help formulate the best response to income tax notices.